The Future of Going Public: What makes an IPO market tick?

Henri Putkonen

The number of public companies has globally been on a downward trend since 2000. There are several reasons, but one key factor — alongside the increased availability of capital sources for companies — is the regulatory environment, which became more stringent following the IT bubble and especially after the Financial Crisis. This raises the question: what is the future of the public market? Will IPOs still remain relevant?

At the EU level, it’s been long understood that there would be tremendous benefit from more integrated capital markets. For example, after years of debate, the Capital Markets Union initiative was filed in 2015. Nowadays, this same initiative continues under a different name: Savings and Investments Union (SIU) tries to find means to increase risk capital in the EU region. The goal is to finance, among others, digitalization, green transition, and defense expenditures. The stock exchanges around EU are actively participating in shaping the initiative.

Alongside this initiative on the EU level, the stock exchanges have over the years merged to a large extent, gaining significant scale benefits. However, the President of Nasdaq Helsinki, Henrik Husman points out the practical difficulties: “At the end of the day, Finnish publicly traded companies follow Finnish legislation, are liable for Finnish tax regulation, and follow Finnish Corporate Governance Code. Whatever you do, you cannot make a Finnish public company a Portuguese company. For an international investor, H&M is under different legislation compared to Wärtsilä.”

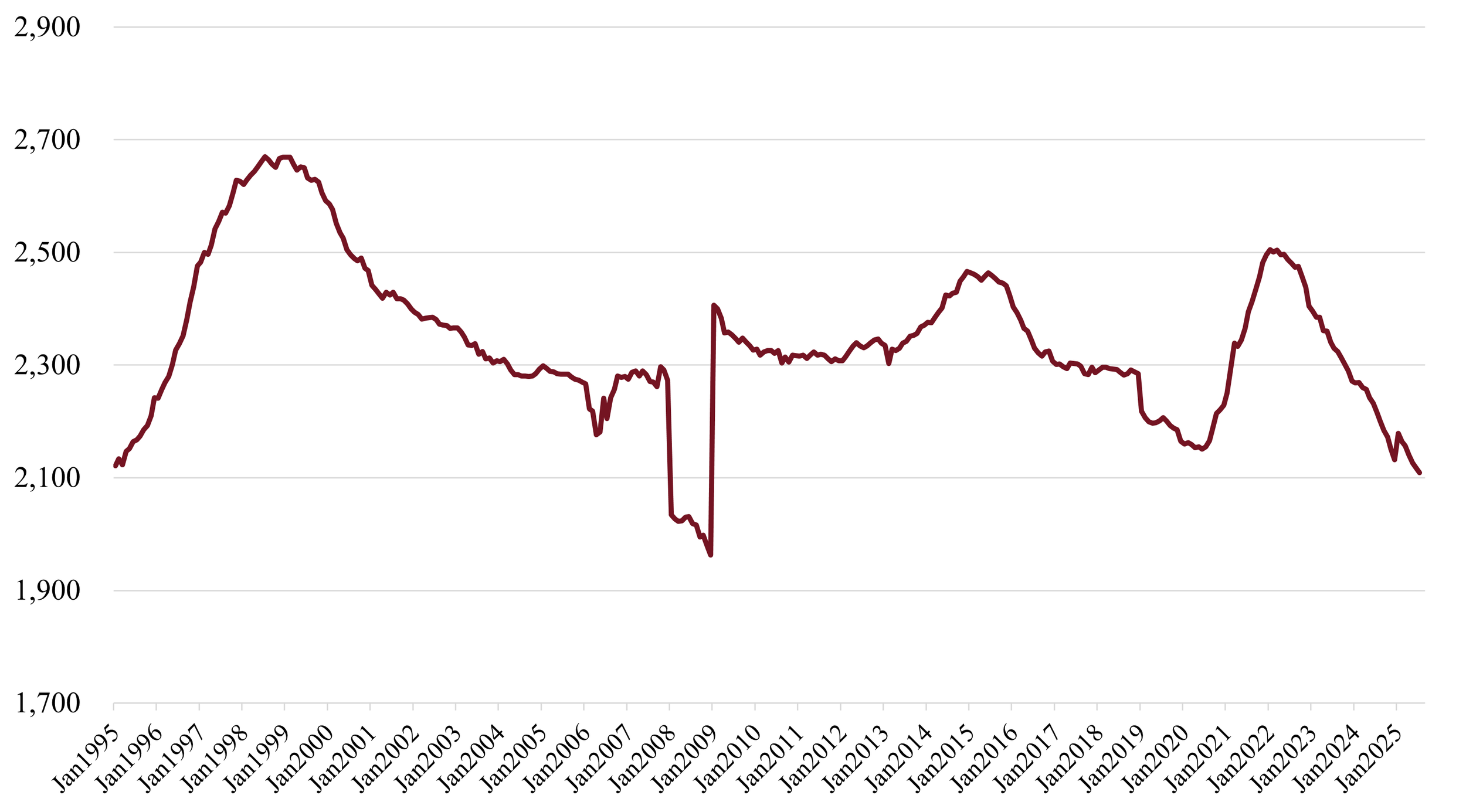

The number of companies listed on the New York Stock Exchange. Source: World Federation of Exchanges.

Even to this day, one could see stock exchanges being ultimately local. “Among the Nordic options [Finland, Sweden, and Denmark], 96% of Swedish retail investors’ funds are flowing into Swedish publicly traded companies. Even though you could invest into a Finnish company within the same application, with largely the same commission.”

Despite the local biases in stock exchanges, companies do have an option to go public wherever they choose. This stresses an important question for companies: should it IPO in its home country or try to gain a better deal elsewhere? “If you are not Spotify, it almost without exception yields the best result to go public in the country with your headquarters and most of your business activity,” Husman argues. “In practice, it is difficult to find international institutional financing without national, reputable anchor investors.” For this reason, maintaining a strong national capital market is vital. However, if you are an unicorn, it is a different story.

From the national point of view, it is paramount that the national listings market stays healthy. “Without publicly trading companies, we have nothing. There would be no trading, no market data, no stock exchange,” Husman points out. For a long time, media has painted the narrative that the Finnish listings market is not active. In fact, the IPO market has been great in Finland, compared to other EU countries. “We have had years where there have been more firms going public in Finland than in Germany.” If you look at relative numbers considering the size of the economy, the distinction is even greater.

Announced IPOs in three EU countries. Source: Bloomberg.

“Of course, it is still beneficial to strive for more IPOs.” As a comparison is often drawn to Sweden, it is noteworthy that the levels of new listings in Sweden are the best-in-class in Europe. Husman urges that the ecosystem of the stock exchange itself is in great shape. “Growing number of the challenges are European or even global. For example, the extreme uncertainty caused by the tariffs are one cause for the currently sluggish market.” According to Husman, there is a long list of companies waiting to go public once the environment is more stable. “It is a question about valuation of the company. The firms can often wait for even multiple years until the environment is optimal.”

What the stock exchange itself can do has been done: world-class software has been developed, trading across different exchanges has been harmonized, and international investors are being attracted. “In Sweden and in Finland, we have implemented the exactly same system – and Sweden’s noticeably higher relative IPO levels demonstrate that the strategy works.”

Yet, there are differences on the national level. The IPO market depends on two things: Firstly, do firms want to go public? Secondly, are the investors attracted enough to the firm going public?

Considering whether firms want to go public, it is quite critical that the firms have a drive for growth. In Finland, ETLA has studied how many firms are growth oriented, and the fraction is significantly lower than elsewhere in Europe (ETLA Discussion Paper 1197). Moreover, there are differences in factors that affect the attractiveness of Finnish companies for investors and the availability of risk capital: capital taxation, financial knowledge of citizens, and the pension system to name a few.

Annual IPOs in Nasdaq US and Nasdaq Nordic and Baltics. Source: World Federation of Exchanges.

Another global trend affecting IPOs is the growing capital of private equity firms, especially in the US. Growing amount of private equity capital can act as a substitute for firms to go public. Thus, private equity and stock exchanges support each other, which is why there is continuous collaboration between them.

In practice, when there is more money flowing into PE funds, there are more domestic investments, which in turn lead to more domestic IPOs. The financing of PE firms is significantly higher than a few decades ago. “The ecosystem looks completely different nowadays.” In entirety, it is a magnificent development for stock exchanges. “One of many factors behind Sweden’s IPO levels is the fact that most of the financing of Swedish PE funds are from international Limited Partner (LP) investors.” In EU terms, Finland has a quite large PE scene, but relative to Sweden, we are behind.

Unfortunately, not everyone benefits from the growth of Private Equity. The trend that companies go public at a later stage in their lifecycle means that retail investors miss out on the growth phase. Although, there are exceptions: “Take the Magnificent Seven. Even when some of them have gone public at a later stage, retail investors have most definitely gotten to enjoy the growth of these companies.”

Ultimately, what is important is identifying the problems. The work to fix them will come naturally with raised awareness. Husman ends with stressing the historical development: “You cannot rush creating strong capital markets. Many things are right in Finland. We have gone in the right direction.”

Henri Putkonen is the Editor-in-Chief of AFA Quarterly.